Introduction –

Whenever you have chosen to commercially transfer your transporter account organizations, you are not selling credit card processing organization accordingly, yet you are truly selling yourself. Most potential clients are presently careful that they need credit card processors. What you accept they ought to see is the explanation they need your own organizations. Why might it be really smart for them to pick you, if there are numerous others who can offer them the very same thing? Show the benefits clients will obtain from you and notwithstanding as far as possible they could get from your organization. Have some familiarities with how to start a payment processing company? A higher advantage drive is more captivating as an endeavour to make it happen rather than just focusing in on the minimal expense offer.

Yearly Payments and Other Charges –

A choice as opposed to holding your rates is doing without various costs, for instance, yearly payments or other charges. You can similarly show the errand wrapped up with your various sellers. If you would be capable, show numbers as confirmation of improvement, and go through your brokers’ recognitions for back your organizations. Never be reluctant to talk yourself to potential clients. Interface with each opportunity and strike the iron while it’s hot. You should moreover return again to your basic pitches to clients. Building a prevalent relationship with them will get you very far when they finally agree to join to your business. Individuals generally set out and start a credit card processing organization have all of the gadgets they need for progress with Brought together Payments. Likewise, take a gander at how to become a payment processor? online here. Contemplate using an aggregator. Aggregators resemble transporter banks, yet are not financial organizations. However, they really can run transporter records and work with credit card trades. For example, PayPal functions as an aggregator. It licenses you to recognize all critical credit cards and charges a discount rate that vacillates considering your arrangements volume.

Meeting the Needs of Merchant Banks –

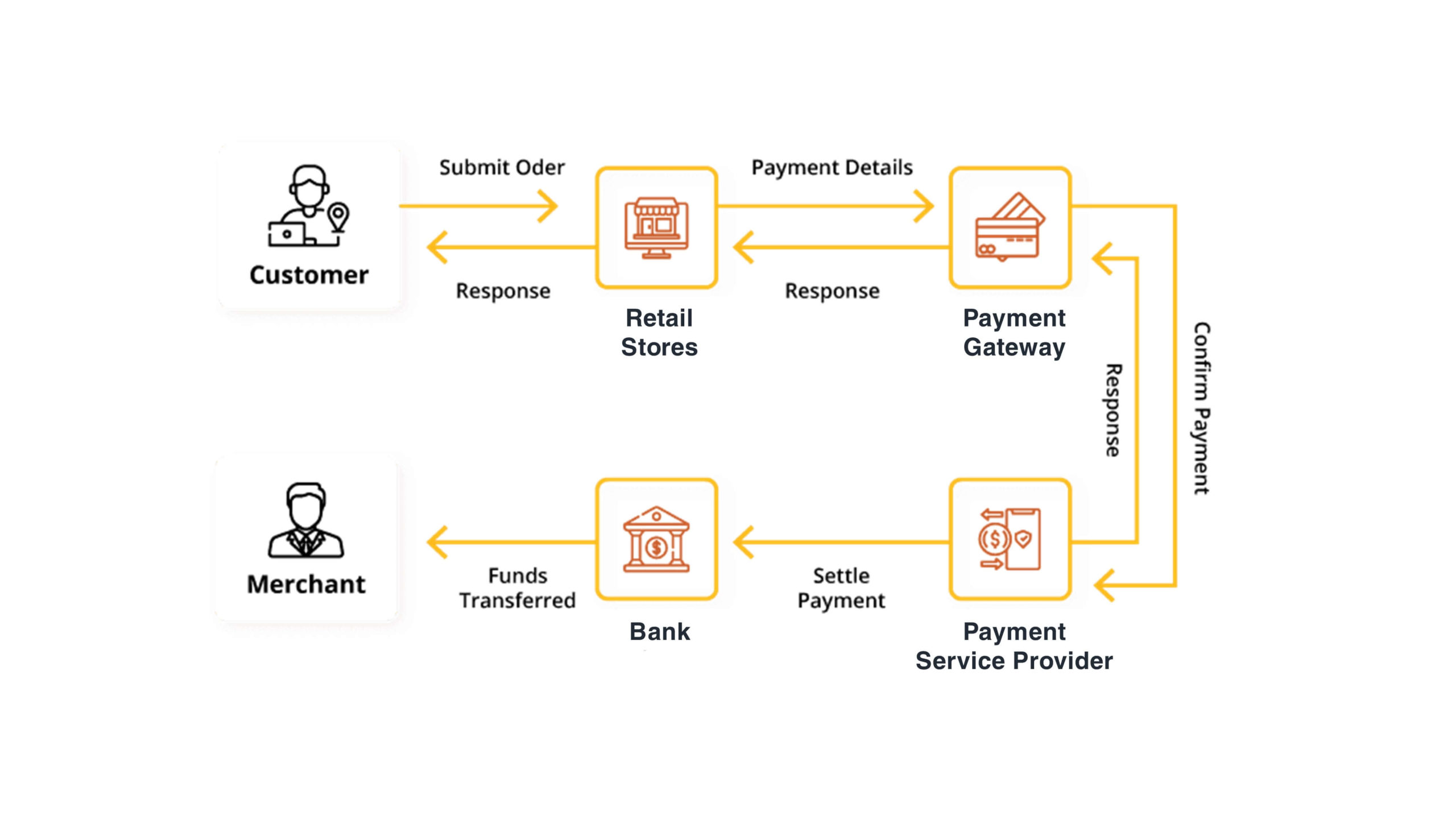

Aggregators a portion of the time offer business deals with serious consequences regarding significantly more humble organizations that may not meet the pay essentials of a piece of the greater transporter banks. If you don’t meet the necessities for a merchant bank, another decision is to select the help of a credit card processor. These organizations assist more humble or fresher organizations with recognizing credit cards by going probably as the transporter account holder for different more unobtrusive organizations. Essentially, they go probably as a middle man between your business and the seller bank and give you permission to credit card deals.

Processor is Costly Compared to Aggregator –

Take care while exploring this kind of strategy, as using a processor could end up being more exorbitant than using an aggregator. Payment processors should be used when your business isn’t adequately tremendous to meet the necessities for teaming up directly with a dealer bank. Set up convenient payments. Expecting you are a convenient business or a creating business that goes to exhibitions or similar events, it may be important for you to find a processor that can help you with enduring credit cards in a hurry. These processors work in fundamentally similar way to typical processors, yet furthermore regularly give a card scrutinize that plugs into your phone or tablet. Research a couple of these processors, and their associated cost structures, to find one that obliges your business.